US marijuana legalization vote in US House this week might make the Tilray stock another GameStop

- moneypig001

- Mar 27, 2022

- 5 min read

Updated: Mar 31, 2022

Written by Moneypig Trading Inc. on March 27, 2022

Marijuana, cannabis, weed, pot all suggest the same thing, and this article might use them interchangeably.

The House in the USA will vote for marijuana legalization (H.R. 3617, the MORE Act) at 1 pm EST, March 30, from the originally scheduled March 28 (https://rules.house.gov/news/announcement/meeting-announcement-hr-3617-more-act). Tilray Brands, Inc. (NASDAQ $TLRY) is the largest marijuana company in Canada and one of the most prominent marijuana players in North America after merging with one of the largest players in the sector, Aphria ($APHA), in 2021. Tilray Brands, Inc. diversifies itself with 20 different brands, including marijuana-related beverages, spirit, food, and other cannabidiol-related products. Also, $TLRY also expands in various geographical locations such as Canada, U.S.A., E.U., Israel, etc. In the last House legalization vote back to Jan 2021, $TLRY went up from $8/share to $67/share in a month. However, $TLRY stock has been dropping from the 2021 high at $67/share non-stopped due to losing market share, the cannabis legalization failure at the Senate in 2021, stock dilution after the Aphria merger, and the general stock market weakness.

(Ads: if you would like to get $100 credits to buy discounted electronics gift cards, feel free to sign up at our partner piggy.cards !)

Figure 1. $TLRY stock price daily chart in 2021 and 2022

Now another round of marijuana legalization vote is around the corner, and $TLRY and many other marijuana stocks are heating up again, such as $CGC, $ACB, $HEXO, $ERBB, $VFF, etc. With the latest $TLRY short interest at 14.9%, extremely high volume, and large long call options open interests, $TLRY and other heavily shorted marijuana stocks could post a GameStop $GME type of move or just repeat its January 2021 move again.

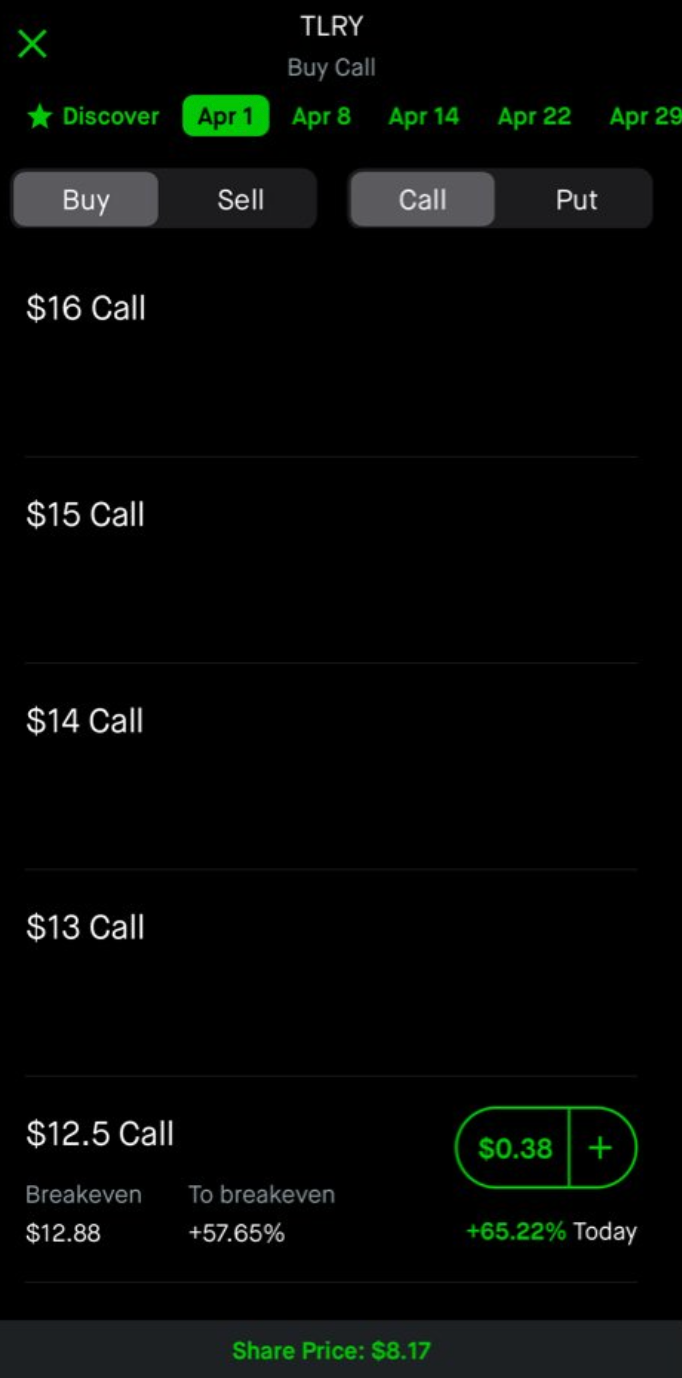

There are several higher $TLRY options strike prices opened next week (Figure 2). Suppose those $TLRY long call options continue to be bought up on the marijuana legalization speculation. Market makers will have to sell more call options to counter the heavy long call options volume. For market makers to hedge their sell call positions, they will have to long more underlying stocks and further bring up the stock price. This event is the so-called gamma squeeze, an essential ingredient for making a stock price hyperbolic like $GME. However, one risk to be aware of is that most of the U.S. stocks traded with heavy options volume often come with significant volatility, and hence a lot of gains are easy to come and easy to go.

Figure 2. There are several higher $TLRY options strike prices opened next week

$TLRY Fundamentals

$TLRY has been posting revenue growth each year. We expect $TLRY to post about 32% revenues growth in 2022 ($680M) compared to 2021 ($513M). This 2022 number excludes the potential upside from the U.S. and E.U. marijuana legalization discussed below. However, $TLRY still posts negative EBIDTA -$22.68M and negative cash flow -$101.4M. So it is not a solid cash-flow positive and highly profitable growth stock like FANNG. It has also been difficult to value the marijuana business due to the regulatory hurdles across different countries, cash not being able to deposit in banks across the USA, etc. Fundamentally, Wall Street analysts are currently rating $TLRY price target on average around $10/share.

$TLRY International Expansion is the Key

Canada has legalized cannabis since October 17, 2018. However, the competition among the cannabis business in Canada is real. Tilray is losing market share in its current largest market, Canada: from 20% to around 10%~15%. There are so many smaller cannabis players in Canada that offer cut-throat prices and eat up $TLRY'S market share. When I was in Toronto, the most stores I saw were boba tea stores, and cannabis stores were the second in the rank. Of course, I am exaggerating, but the Google Map search below in Toronto downtown gives you some ideas (Figure 3).

Figure 3. Look at how many cannabis shops in downtown Toronto, Canada

Instead of focusing on the Canadian market, $TLRY's strategy is to position itself to more significant markets such as U.S. and Europe, where marijuana is not legalized yet. Therefore, buying $TLRY stocks here is a direct bet on marijuana legalization in U.S. and Europe which will significantly push up $TLRY's revenues and stock prices.

Tilray is well-positioned in Europe, where Malta has legalized cannabis. The new German government formed by the Social Democrats (SPD), Greens, and Free Democrats (FDP) are working on legalizing cannabis as well. However, the German government might be distracted by Ukraine War, and it could delay the cannabis legalization process.

U.S. Marijuana Legalization Battle

For the U.S. to legalize marijuana, the MORE Act needs to pass the vote in House and Senate accordingly, and the MORE Act has to be signed by the U.S. president. Marijuana legalization was widely supported by the U.S. House back in 2021 and still is the case in 2022. Therefore, it is widely expected that marijuana legalization will pass in the House vote this coming week. However, marijuana legalization failed in the 115th Senate back in 2021. Since the marijuana-friendly Democrat to Republican ratio is closer to 1:1 in the current 116th Senate compared to the 115th Senate (Figure 4), the chance of marijuana legalization passing is higher in this round. The mid-term elections will be held on November 8, 2022, further promoting the U.S. Congress to push the legalization through this time to fulfill their marijuana legalization promise. Therefore, the market reaction to marijuana stocks might be even more bullish than in 2021, in our opinion.

Figure 4. US Senate Composition

What are your thoughts on the market reaction to marijuana stocks this time? We have a live Twitter poll here (Figure 5), and feel free to participate!

Figure 5. MoneypigTrading Twitter Polls

Moneypig Trading has a very robust discord program (https://moneypigtrading.com) with a great track record. Since Oct 2020, our winning rate is always larger than 50% except Jan 2022, and our average return per trade is always larger than 0% except Jan 2022. These numbers suggest we pretty much always make money every month, again, except Jan 2022.

Figure 6. Moneypig Trading Swing Trading Program Performance

We also have a very solid stock focus long-term investment Discord program, as shown in Figure 7.

Figure 7. Moneypig Trading Long Term Investment Program Performance

If you are interested in our Discord community, make sure to check out https://moneypigtrading.com! Also, don’t forget to give us a thumb up, and follow us on our social media!

Twitter: MoneyPigTrading

Youtube (English): MoneyPigTrading

Instagram: MoneyPigTrading

Linkedin: MoneypigTrading

Also, if you would like to get $100 credits to buy discounted electronics gift cards, feel free to sign up at our partner piggy.cards !

Thank you for reading and have a great day!

Moneypig Trading team

Just a quick disclaimer: Moneypig Trading (https://www.moneypigtrading.com/) is not a financial advisor. Please invest at your own risk. We are also long $TLRY stocks and call options.

Comments